Inquire

Indices

According to the Notaires de France-INSEE (French National Statistics & Economic Studies Institute) index, in the fourth quarter of 2015 prices of older properties increased slightly for the second straight quarter, up 0.4% compared with the third quarter of 2015 (provisional seasonally-adjusted figures) after rising 0.2% the previous quarter.

Over one year, prices of all older properties were virtually unchanged (-0.2%). For the first time since the beginning of 2012, home prices increased relative to the same quarter the pre-vious year, rising by 0.4% between the fourth quarter of 2014 and the fourth quarter of 2015. Prices of apartments continued to fall, but at a lower rate (down 1% over one year after decreasing by 2%).

In Greater Paris, prices of older properties were relatively stable in the fourth quarter of 2015 (up 0.1% after rising by 0.4%).

Over one year, the decline in prices continued to ease: -0.8% compared with the fourth quarter of 2014, after a drop of 1.6% in the third quarter and 2.5% in the second quarter. Apartment prices fell by 1%, while home prices remained virtually stable (-0.2%).

Image (1000*yyy)

In the provinces, the prices of older properties increased in the fourth quarter of 2015: +0.5% compared with the previous quarter, after increasing by 0.1%.

Over one year, they were stable compared with the fourth quarter of 2014. Here as well, home prices were up (by 0.5% over one year), while prices of apartments continued to fall (-0.9% over one year).

2015 status report

In the fourth quarter of 2015, the volume of transactions continued to grow, resulting in a slight increase in prices for the second consecutive quarter.

This is now sufficiently worthy of note, after a downward trend in prices since the third quarter of 2012.

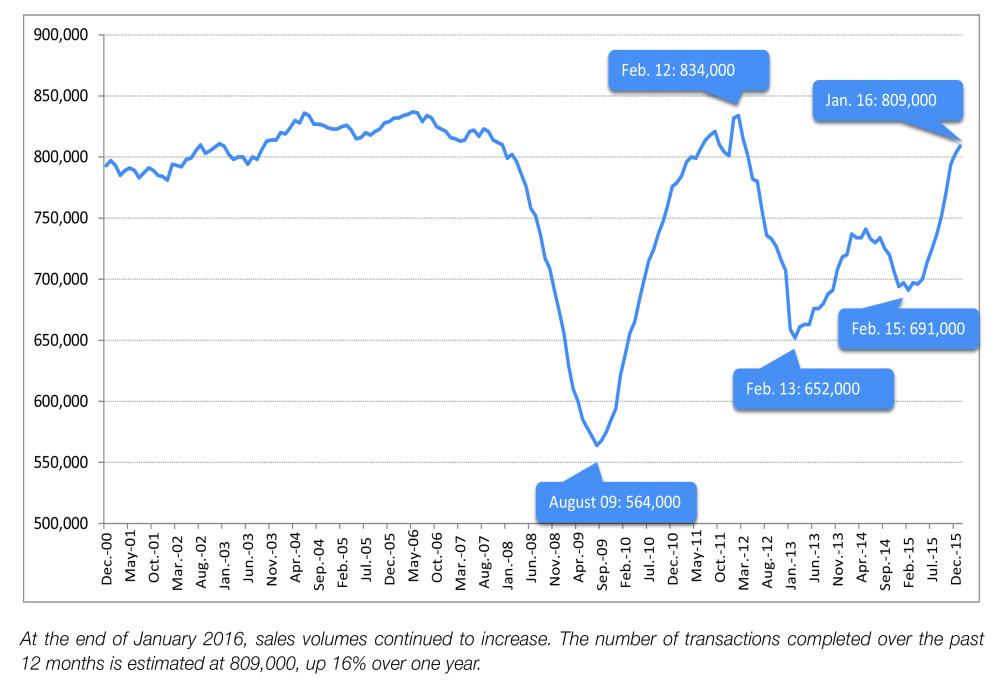

In 2015, the increase in the volume of transac-tions nationally was similar to that of 2013, with approximately 100,000 additional transactions bringing the number to 809,000. Expressed as a percentage, the number of transactions rose by 16%.

Unlike in 2013, when growth was constant and continuous over 12 months after reaching a low point, the number of transactions rose by as much but over a shorter period (approximately eight months), reflecting a strong and sudden appetite for real estate. More specifically, only the departments of Indre, Lozère, Haute-Corse and Cantal recorded a decline in sales volumes (between 2% and 5%), which was relatively insignificant compared with increases in the number of transactions of up to 25% in departments like Morbihan, Pas-de-Calais and Charente-Maritime.

This increase in volumes led to an upward trend in prices, yet without moving them into positive territory: its effect was simply to stop the fall in prices, which remained stable in 2015 as a whole given the decline during the first two quar-ters. It should be noted that only home prices saw a positive variation during the last quarter, while the change in apartment prices remained slightly negative (-1% year-on-year). Nevertheless, the increases make up for the 2% to 3% decline observed during the first two quarters, which is significant in such a short time period.

Image (1000*yyy)

2015 will therefore remain the year of a change of polarity in price trends, but without being enough to compensate for the erosion in prices that occurred during the previous three years.

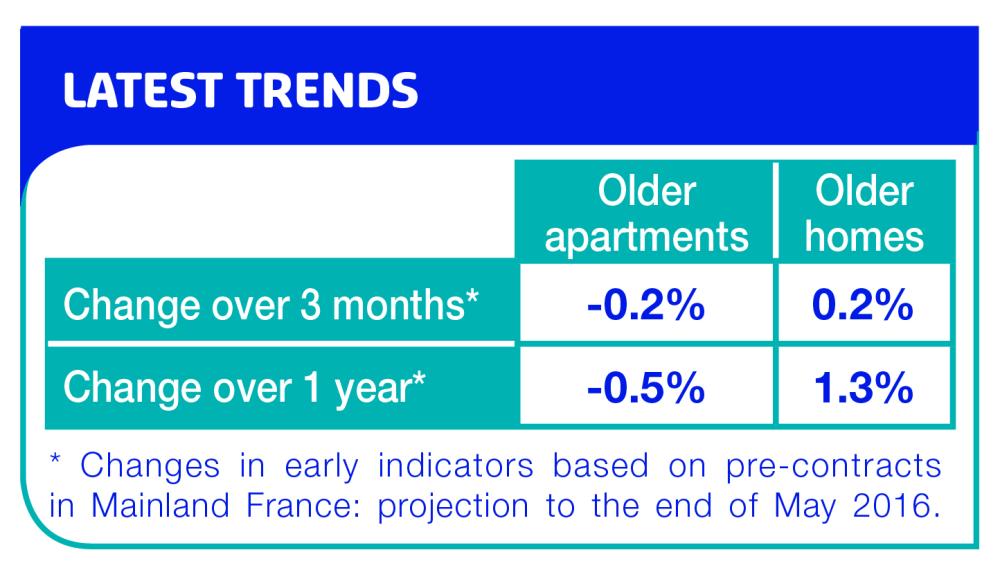

Pre-contracts

The projection of the price index for older apart-ments throughout Mainland France based on pre-contracts indicates a decrease in apart-ment prices and a slight increase in home prices (+1.3%) over one year.

In the provinces, the early indicator for older apartments is down slightly (-0.2%). Homes are following the national trend with an increase of 1% over one year.

Image (1000*yyy)

In Greater Paris, early indicators on pre-contracts show that the price stability observed in 2015 for older apartments should continue in early 2016. With regard to older homes, these indicators suggest a slight rise in prices.