The PINEL system is a rental investment mechanism to obtain a tax reduction (tax exemption system). Since September 1, 2014, it has replaced the DUFLOT system.

Inquire

Rental property investment is about buying a property to rent it, in order to receive an additional income.

Pinel system: can you benefit from this ?

This concerns taxpayers who buy, until December 31, 2021, while they reside in France:

- a new home or in the future state of completion (VEFA, known as buying off plan). Note: from January 1, 2021, only acquisitions of new housing or in the state of completion "in a collective housing building" are eligible for the Pinel system.

- housing they have built.

- old housing undergoing major works and being transformed into a new housing.

- housing which isn’t in keeping with the standards of propriety and goes through major rehabilitation works.

- a premises assigned for a purpose which is other than housing and subject to major works of housing transformation.

Completion date

These accommodations must be completed within 30 months of the building permit, if you are building or the date of signature for the authentic act of acquisition in case of an accommodation which was acquired through VEFA, and December 31 onward of the 2nd year following the acquisition of housing, if you were to renovate.

PINEL system simulator

Through the Pinel law simulator, calculate your tax savings, easily.

You can verify:

- if your municipality is eligible for the system?

- calculate the rent limit at which you can rent your accommodation?

- know the maximum income limit of your future tenants?

- know the amount of tax reduction you can benefit from?

Pinel system: conditions related to housing

Energy efficiency

To benefit from the so-called Pinel tax reduction, housing must reach an overall energy performance level, depending on the type of acquisition:

1. new housing: RT 2012 thermal regulation

2. existing building: building undergoing works to equate it with a new housing. It must:

- either obtain a "High energy performance, HPE renovation" label,

- or obtain the " low energy consumption building renovation, BBC renovation 2009" label.

Zoning

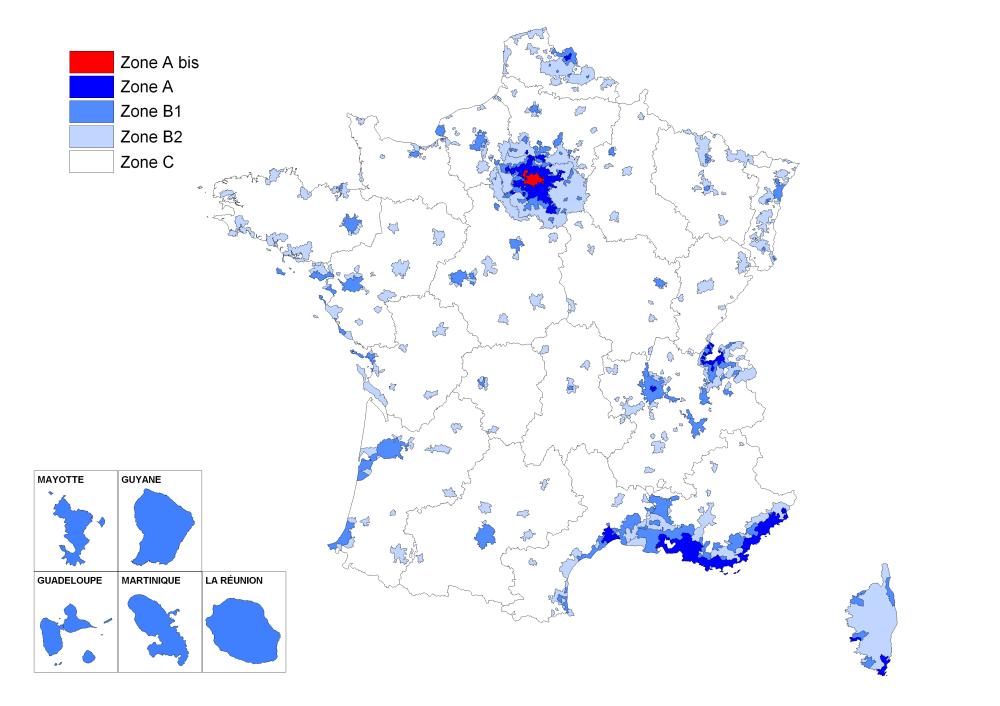

The application of the device assumes that the housing is located in a municipality which is classified in a geographical area, characterized by a significant imbalance between the supply and demand for housing. The concerned zones are A, A bis and B1.

- Since January 1, 2018, the system has been applicable to housing located in municipalities whose territory is covered by a defense site revitalization contract.

- Since January 1, 2019, housings located in municipalities which have been covered by a defense site revitalization contract within 8 years preceding the investment, are also eligible for the tax reduction.

Please note: the tax reduction also applies to the acquisition of housing located in zones B2 and C which have been approved and have requested for a building permit application, no later than December 31, 2017 and on the condition that this acquisition shall be completed, no later than March 15, 2019.

Click on picture to enlarge the zoning map of PINEL System

Image (1000*yyy)

Experimentation with the regionalization of the Pinel system in Brittany

Until December 31, 2021, this tax reduction in Brittany shall apply exclusively to housing located in municipalities or parts of municipalities characterized by a high tension in the rental market and the requirement for significant intermediate housing, determined by a decree of the regional prefect. The rent and resources limits of the tenant shall also, for each municipality or part of the municipality and by type of housing, be determined by the regional prefect. Taxpayers benefiting from the tax reduction for investments carried out in Brittany must subscribe for an annual declaration, the terms of which shall be specified by decree. These provisions will apply to the housing’s acquisition and in the case of housing that the taxpayer builds, to applications for building permits subsequent to a date which is set by the prefect's order and the latter may not be later than July 1. 2020.

However, the current system remains applicable to housing acquisitions in the Brittany region, for which the taxpayer can justify:

- with regard to the acquisition of accommodation in the future state of completion (VEFA), a preliminary reservation contract must be signed and filed with a notary or registered with the tax department, at the latest by July 1, 2020;

- in other cases, an offer to purchase or a bilateral promise to sell signed on or before the same date.