Inquire

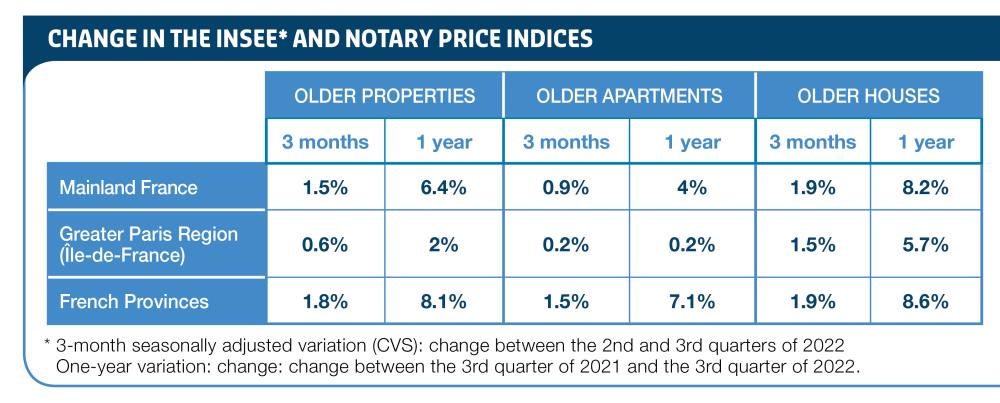

INSEE and notary price index variation

Image (1000*yyy)

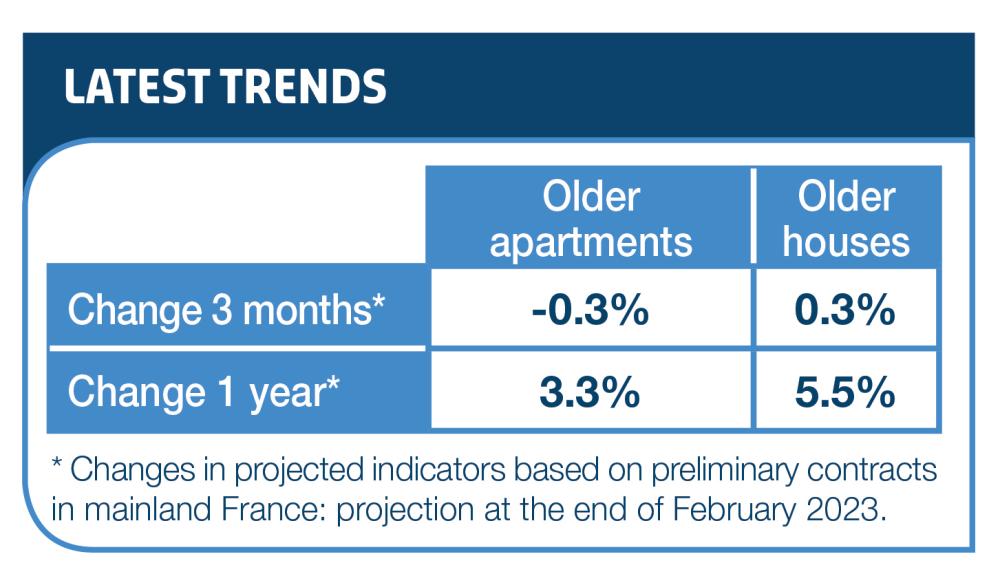

Image (1000*yyy)

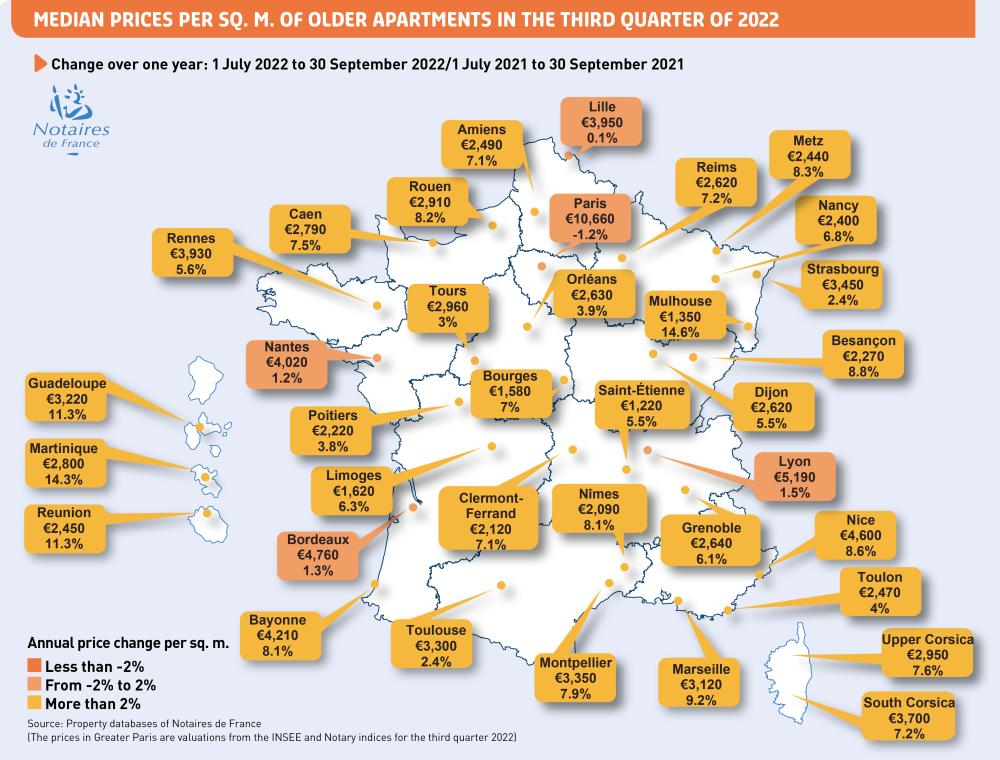

Median price per sq.m. for older apartments in the 3rd quarter of 2022

Image (1000*yyy)

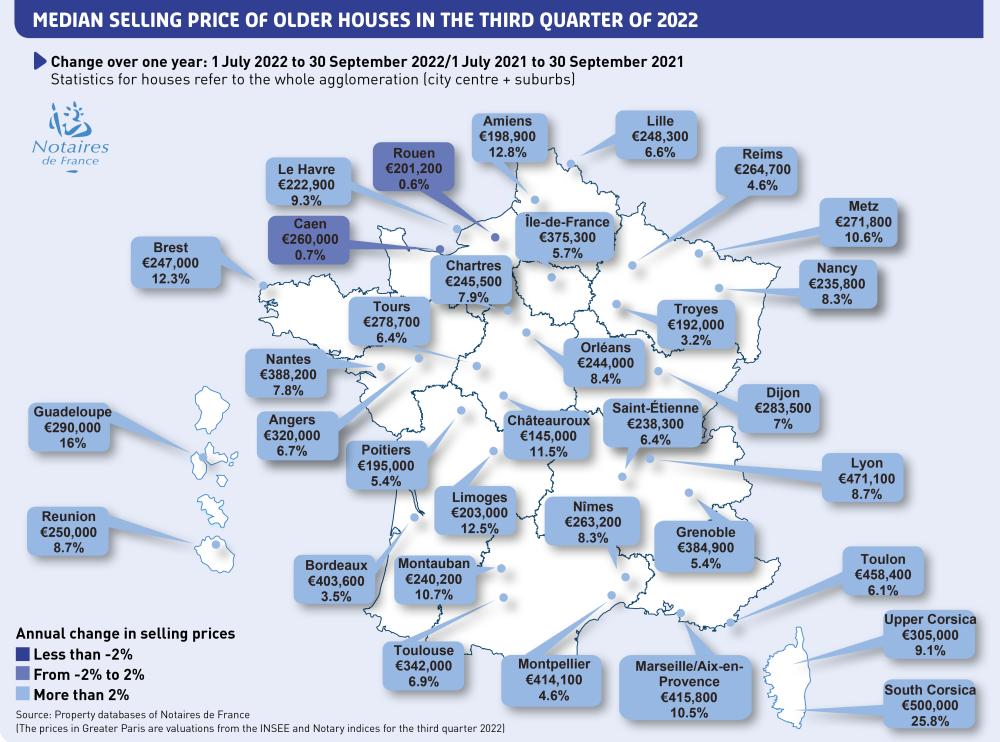

Median selling price of older houses in the 3rd quarter of 2022

Image (1000*yyy)

Credit - Banque de France data - Results at end of August 2022

In November, the seasonally-adjusted flow of new housing loans amounted to €18.3 billion (after €18.6 billion in October), while interest rates continued to rise, with the effective rate in the narrow sense (i.e. excluding fees and insurance) averaging 1.91% (after 1.77% in October). The annual growth rate of outstanding housing loans stood at +5.7% in November, after +5.9% in October. The growth rate of consumer credit was +4.0%, after +4.3% in October.

The December estimate for new housing loans indicates a continued rise in the average interest rate to 2.04% and a monthly seasonally-adjusted production of these loans of €15 billion. Over the year, the growth rate of outstanding housing loans is estimated at +5.5%.

Excluding renegotiations, and adding the very first estimates for December, cumulative new loan production for the year should be €218.4 billion, i.e. an all-time high apart from the exceptional year of 2021, which 2022 only falls short of by 3%.

Image (1000*yyy)