Inquire

A declining market

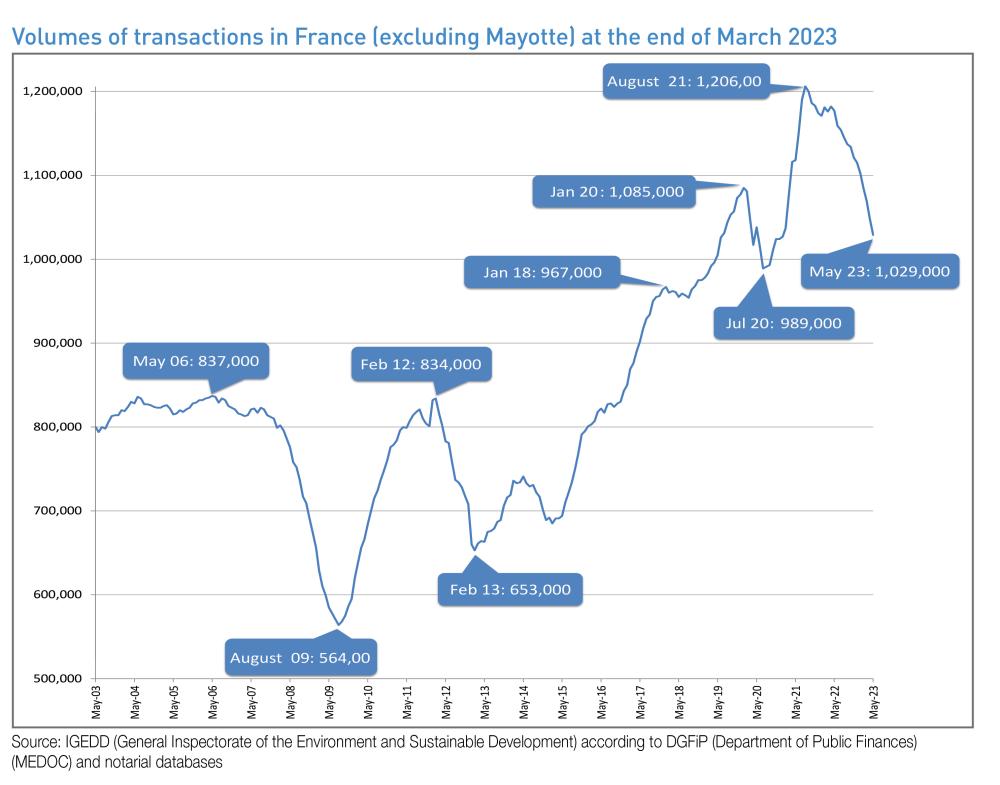

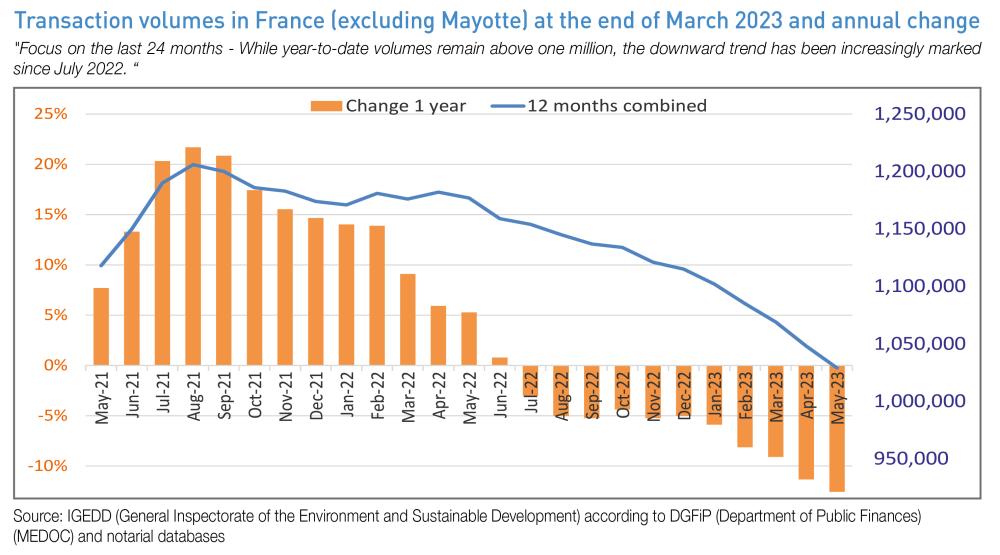

At the end of May 2023, the cumulative volume of older property transactions over the last twelve months in France (excluding Mayotte) reached 1,029,000 transactions. Since August 2022, the number of transactions completed over the last twelve months fell around 5% month by month, but since the beginning of this year, the falls have increased by more than double (-12.6% at the end of May 2023). The decline in volumes can be directly linked to the current inflationary environment and to the sharp and rapid rise in interest rates, but also to the end of a gold age where all the parameters would contribute to a euphoria which itself led to the inevitable end of this cycle. Notaries also note that spring, traditionally synonymous with peak activity in the real estate year, will not have seen a catch-up effect this time, confirming a market that is increasingly slowing down.

According to the projections from preliminary contracts at the end of July 2023, prices of old dwellings in metropolitan France enter a declining phase: after the gradual deceleration of the price increase observed since September 2022, prices are expected to decrease by 1% year-on-year. The decline of the multi-unit dwelling market (down 1.4% year-on-year) was stronger than that recorded on the single-unit dwelling market (-0.7%).

Volumes of transactions in France (excluding Mayotte) at the end of march 2023

Image (1000*yyy)

Transaction volumes in France (excluding Mayotte) at the end of march 2023 and annual change

Image (1000*yyy)

Outside Paris, prices of old dwellings still held up at the end of July 2023, with an annual increase of +0.2%. Contrary to the observation made in mainland France, the prices of old apartments (+1.2%) continued to rise slightly while those of old houses remained almost stable (-0.2%). At the end of July 2023, the vast majority of municipalities in which prices for old apartments increased further in Q1 2023 would show stable or lower prices at the end of July. For example, this is the case for Rouen and Nantes, where prices were stable at the end of March 2023, but are expected to fall by around 4% at the end of July 2023. In Lyon, prices decreased by 3% compared to -1% in Q1 2023. In terms of the sales of old houses in the large cities at the end of July 2023, the

finding would be similar with higher negative trends than for old apartments. The falls would be between 4 and 9% in the large cities of Angers, Saint-Étienne, Nantes, Lille, Dijon, Toulouse, Rouen and Strasbourg.

In Île-de-France, an increasing drop in activity and the decline in demand led to further price adjustments: annual price reductions would become more widespread to all Ile-de-France markets by July 2023. In addition, the annual rate of decline is expected to accelerate (-4.8% for apartments and -3.2% for houses in July). This would be a departure from the observed trend between 2013 and 2015 with annual declines of around 1 to 3%. But it would still be less rapid than the levels recorded during the subprime crisis where annual price reductions had occasionally came close to 10% in 2009. In Paris, the price per m² amounted to €10,310 in the 1st quarter of 2023. The decline, so far limited to 2%, would increase to 5% yearon- year in July 2023 for a price of €10,090. The

continuation of the downward trend could lead to prices below €10,000 per m² during the 3rd quarter of 2023.

The announced price adjustment, a logical and mechanical consequence of the drop in volumes, is fast approaching, albeit disparately across the country, with some areas still benefiting from their natural attractiveness, such as the coastline.

However, the period of rising prices, boosted by abnormally low interest rates, is long gone. The market still needs to find its new dynamic, with the sharp rise in interest rates dissuading buyers and pushing aside first-time buyers whose income levels are no longer sufficient to consider a purchase. The pool of potential buyers has been largely modified by an increasingly complex use of credit and the fact that French people are left with less money to spend on properties. At the same time, notaries have noted a return of traditional negotiations everywhere, coupled with a mechanical increase in sales times due to a wait-and-see attitude on the part of buyers. The market, after mostly benefiting sellers, has now turned around. There can be a breakthrough only when sellers agree to lower their price, which, given the rises in recent years, is by no means unacceptable for the time being. Nevertheless, it should be noted that these price and volume reductions will have an impact at local level on the collection of transfer duties for consideration, in an already fragile situation for public finances.

Against this gloomy economic backdrop, the Banque de France nonetheless forecasts that "after peaking in the second quarter, overall HICP (Harmonised Index of Consumer Prices) inflation is expected to gradually come down in the second half of 2023 and beyond, returning to around 2% by 2025, provided there are no further shocks to imported raw materials."1

In any event, the year could end with around 950,000 transactions completed, marking a very sharp slowdown over one year, back to a pre- 2018 level. The real estate market as a whole is undergoing a period of sudden readjustment in which the new home market has declined sharply, due to the failure of the public authorities to adopt a new Pinel-type rental investment scheme, but also due to constrained production costs for developers which, correlated with an inevitable increase in the savings effort imposed by the rise in interest rates, squeeze potential buyers even further.

1 - https://publications.banque-france.fr/projections-macroeconomiques-juin-2023

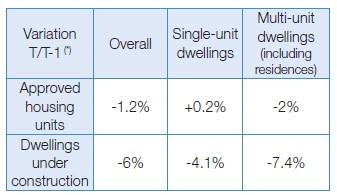

The new home market - Key figures

Residential construction

St@t info No. 561 - June 2023

Figures at the end of May 2023

Image (1000*yyy)

Last three months compared with the previous three months.

Source: SDES, Sit@del2, estimates at the end of May 2023

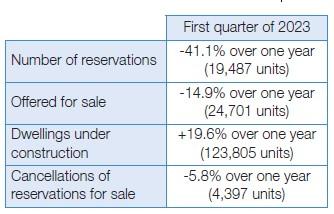

Sales of new dwellings

St@t info n° 548 - May 2023

Results of 1st quarter 2023

Warning: as from February 2023, the series published are corrected for seasonal variations and working days (CVS-CJO).

In addition, data on the sales of new dwellings to private individuals now includes new renovated and refurbished dwellings, i.e. from construction of existing dwellings.

Image (1000*yyy)

Source: SDES (Statistical Data and Research Department), ECLN (Survey on the marketing of new housing)

The annual change is calculated on the uncorrected data of seasonal effects.

Credit - Banque de France data - Results at end of May 2023

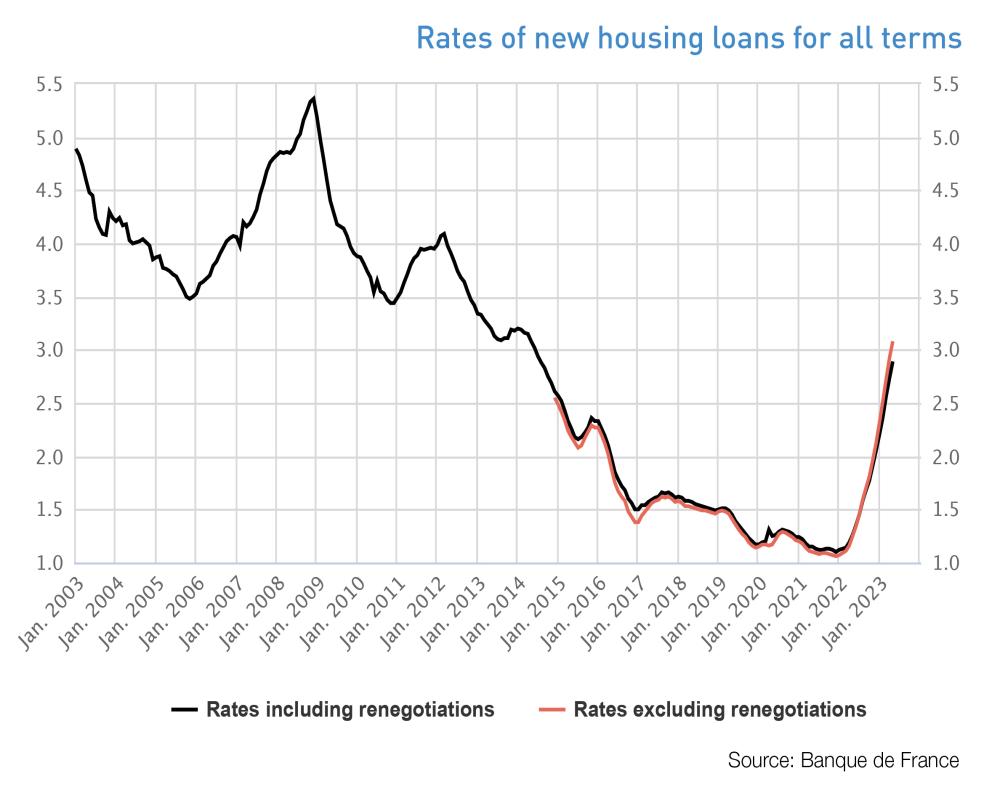

The quasi-systematic use of non-revisable fixed real estate rates continues to provide security for French borrowers as well as for the loans and collateral of national retail banks.

Monthly housing loan production reached €12.1bn in May

In May, the CVS flow of new housing loans excluding renegotiations amounted to €12.1bn, an amount comparable to that observed in recent months (€12.2bn in February and March, 12.6 in April). Loan production is therefore still higher than that which existed before the period of exceptionally low rates and very high production volumes.

The annual growth rate for housing loans slowed down logically, and stood at +3.7% in May 2023 (after +4.1% in April) while remaining higher than that of our European neighbours.

The narrowly defined effective rate - NDER - i.e. excluding fees and insurance, averaged 3.08% in May for new loans excluding renegotiations,

up 16 base points compared to the previous month, but still lower than the average rates charged in other major eurozone countries.

Rates of new housing loans for all terms

Image (1000*yyy)

Non-Resident foreigners on the older property market

Return of non-resident foreign buyers in 2022

After reaching its highest level in 2015 at 2%, the share of non-resident foreign purchasers in mainland France fell almost continuously until 2020. After this year marked by the start of the health crisis, it stabilised at 1.3% in 2021. The year 2022 marked the return of non-resident foreign purchasers, which account for 1.8% of old housing transactions1. This observation was confirmed in the 1st quarter of 2023 with an equivalent proportion.

Image (1000*yyy)

This increase could be felt throughout the territory, but it was all the more significant in Provence-Alpes-Côte d'Azur region, where the share of non-resident foreign buyers increased from 3% in 2021 to 3.8% in 2022. However, this share remains much lower than in 2015, where it reached 5.2%. Nouvelle Aquitaine, Occitanie and Bourgogne - Franche- Comté are also experiencing a significant increase in the share of purchases of non-resident foreigners, which accounted for 2 to 2.4% in 2022 (i.e. around +0.5 points over one year). In Bretagne, Hauts-de-France, Centre - Val de Loire and Pays de la Loire, non-resident foreigners accounted for less than 1% of purchases.

Creuse, Alpes-Maritimes and Ardennes are among the most popular departments for non-resident foreign buyers in 2022. While Creuse remains first, with 8% of transactions within the department, it is the region where the share of non-resident foreign buyers decreased the most, particularly between 2019 and 2021, from 11 to 7%. In Alpes-Maritimes, the share of foreign non-resident buyers is stable at 7% compared to 2019. On the other hand, the share of purchases made by non-resident foreigners in Ardennes has steadily increased, from 4% in 2019 to 7% in 2022. It can be noted that ten years ago, they represented only 2% of purchases. In Île-de-France, the share of non-resident foreign buyers reached its highest level over the last ten years, at 1.2% in 2022 and up to 1.6% in Q1 2023. However, they are poorly represented outside of the Capital. After fluctuating around 2.3% between 2019 and 2021, the share of non-resident foreign buyers in Paris reached its highest level over the last ten years at 3.4% (i.e. +1.2 points over one year). At the beginning of 2023, the increase in the share of non-resident foreigners in Paris was confirmed: they represented 4.2% of buyers in Q1 2023.

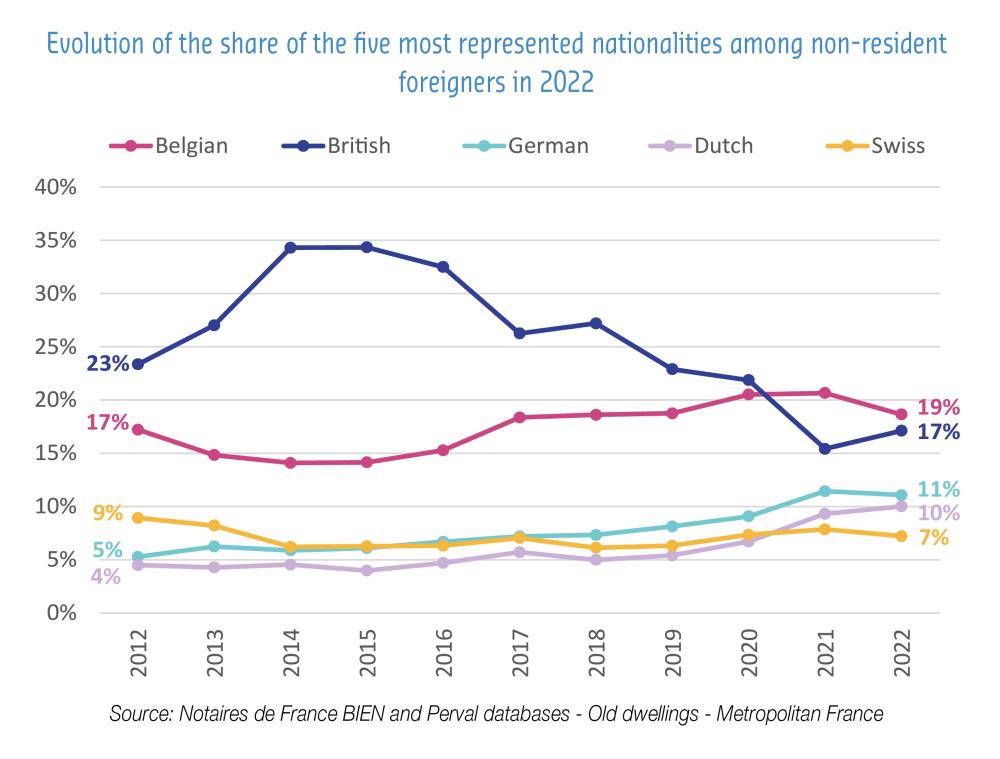

Image (1000*yyy)

The proportion of British, which has been falling steadily since 2016, recorded a sharp decrease between 2020 and 2021 (-6 points), falling below the 20% threshold for the first time. This decline is similar to that recorded between 2016 and 2017 at the time of the referendum on UK membership of the European Union. Despite an increase of 2 points recorded in 2022, they did not return to the top rank, with 17% of purchases among non-resident foreigners. Since 2021, Belgians have been in the lead, with 19% of purchases. However, their share recorded a first decline since 2014, by -2 points over one year.

1 - Just over 17,000 transactions of old apartments and old houses were completed by non-resident foreign purchasers in mainland France in 2022.